I am thrilled and deeply grateful to the voters of Aiken County for their overwhelming support in renewing the capital improvement sales tax for Aiken County Public Schools. This is not just a vote for continued funding—it’s a resounding statement that our community believes in the future of our children and the strength of our public schools. By voting Yes, our community has said Yes to more than a tax renewal. This vote is a commitment to the future of our schools, our students, and our teachers. It means expanded and renovated learning spaces that will better serve the needs of our children, teachers, and staff for years to come. The capital improvement sales tax will help us continue to address infrastructure needs across the district—modernizing aging schools, creating safe and modern learning spaces, and ensuring that every child has access to the updated resources. It is an investment in the heart of our community: our children. Our children are the real winners in all of this. By renewing this sales tax for another 10 years, voters have given our children more tools they need to succeed. On behalf of the entire Aiken County Board of Education, I want to thank our voters once again for their trust, their commitment, and their belief in our public schools. Together, we are building a stronger future for students in Aiken County. Thank you for supporting Aiken County Public Schools. We are excited for what lies ahead!

Cameron Nuessle

School Board Chair

2024 One Cent Sales Tax Information

Information on this webpage was designed to inform our community about the One Cent Sales Tax, and includes some of the school facility needs in Aiken County Public Schools that were on the ballot in November 2024 for voter consideration.

About The 1% Sales Tax

In November 2014, Aiken County citizens approved a 1% sales tax on most purchases to help fund renovations and reconstruction of school facilities in greatest need, including schools built in 1920, 1952, 1953, 1966, and 1968. South Carolina Public Schools do not receive funding for school facilities and construction. The 2014 One Percent Sales Tax was the first successful referendum benefitting school facilities in Aiken County since the late 70s, and schools across the district were showing their age as well as the impact of unaddressed maintenance issues.

The 2014 Sales Tax helped fund the new Aiken High School, North Augusta High School, Leavelle McCampbell Middle School, Ridge Spring-Monetta's K-12 Campus, and updates and renovations to Aiken County's Career and Technology Center (a "contingency" project to be addressed as funding was available). The 2014 Sales Tax revenue exceeded estimated revenues and the new Aiken County Career and Technology Center construction is underway on the campus of Aiken Technical College (with funding also provided by the Mox Settlement).

Construction Updates, information about the Sales Tax Community Oversight Committee, Collections, and more about the 2014 Sales Tax are publicly available on our website page titled "Follow Your Penny."

The One % Sales Tax is a 10-year tax. It does not automatically renew. However, Aiken County's citizens will have an opportunity to consider a renewal of the One % Sales Tax benefitting a new list of school facility needs through a referendum which will be on the ballot in the November 5, 2024, General Election.

After considering ideas, needs, and concerns shared during a series of Community Input Meetings, as well as feedback received through stakeholders that participated in an online survey, the School Board selected facility project needs for voter consideration of funding through a renewal of the One % Sales Tax.

We invite you to learn more about the Sales Tax through this page.

2024 Sales Tax Projects

If renewed, the 2024 1% Sales Tax would benefit the following: renovations and additions at South Aiken High School, Midland Valley High School, Silver Bluff High School and North Augusta Middle School; and construction of a new elementary school in Area Three (Midland Valley High School attendance zone). More on those projects as well as contingent projects that would be addressed as funding is available is below.

South Aiken High

SAHS opened in 1980. Additional classroom spaces have been added to the school over the years. Some of the facility concerns at South Aiken are as follows:

The student exit doors open to the exterior.

The fire alarm system is beyond its service life and needs to be replaced.

The roof leaks and needs to be replaced.

The cafeteria has no windows/light and is too small for the student population.

CATE spaces were not designed for their current utilization.

The Welding Room is outdated and has no space for storage. Many items, including the compressors, are stored outside.

Culinary Arts does not have drainage in the floor, there is no ventilation, the stove is electric (gas is needed for proper instruction).

Fencing and guardrails are in need of repair/replacement.

The wooden exterior doors at the front of the school and at side entrances are rotting.

The interior needs repainting.

An auxiliary gym is needed. Wrestling and cheer currently practice in the cafeteria.

Athletic fields need to be upgraded. The locker rooms need updating and have lockers that are repurposed from another school.

The band stores equipment in at least nine other spaces due to a shortage of storage space for Band, Orchestra and Chorus.

If the One Cent Sales Tax is renewed by voters in November, an early look at the changes at South Aiken High School is below.

Midland Valley High

MVHS was also originally constructed in 1980. Recent additions (2018 and 2020) have helped account for some of the growth in Area Three (Midland Valley). Some of the noted issues at Midland Valley High School are as follows:

The roof leaks and needs to be replaced.

Many doors at the school do not have locks and are a safety concern.

Overall erosion issues need to be addressed, including those on the football and baseball fields.

Parking remains an issue, especially on the dirt parking lots which flood.

There are not enough electrical outlets in the classrooms.

The Culinary Arts space is inadequate: the vents direct back into the room, the cabinets are made of wood, the equipment is dated, the stove is electric and should be gas for instructional purposes, ventilation is poor, and sinks are not up to code (no drain).

If the One Cent Sales Tax is renewed by voters in November, an early look at the changes at Midland Valley High School is below.

North Augusta Middle

NAMS was originally constructed in 1954. While some updates have been made over the years, much of the original campus remains.

The front entrance does not separate visitors from the entry to the school and is not handicap-accessible.

The school's HVAC unit is beyond its service life.

Walls are covered in metal through much of the building and are warm to the touch, making the already a/c challenged school building even warmer.

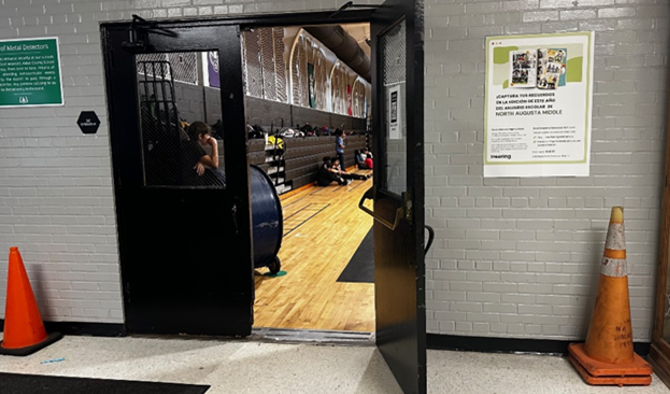

Many of the doors do not fully close and need to be locked for safety. However, this inhibits students from accessing all parts of the campus.

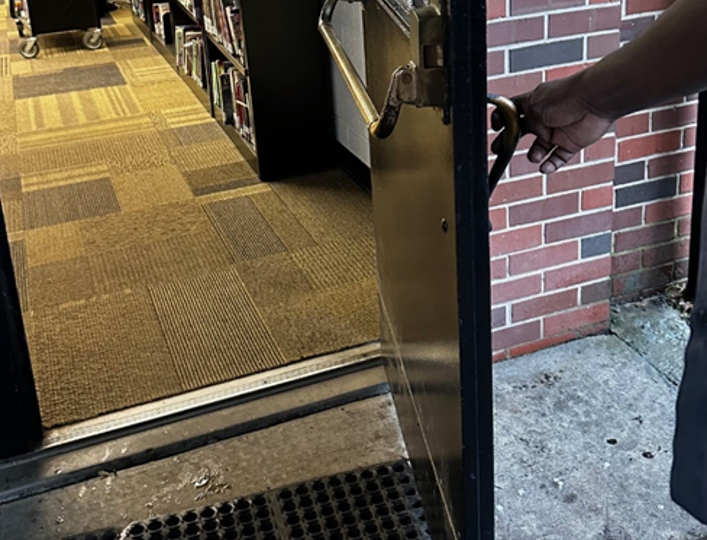

Windows throughout the school leak during heavy storms. Windows, doors, lighting, tile, and the parking lot need to be replaced.

Wiring is exposed through much of the building.

The walkway to the Media Center floods easily and often, damaging flooring in the library/Media Center.

There is no ventilation in the restrooms or circulation in the gymnasium.

An office is utilized as a ticket booth, storage and office space.

If the One Cent Sales Tax is renewed by voters in November, an early look at the changes at North Augusta Middle School is below.

Silver Bluff High

SBHS is the last of the District's high schools that was build in the 1980s. Noted improvements needed at Silver Bluff include:

The front entrance security needs to be upgraded to separate visitors from accessing the school.

Classroom doors are wooden and only lock with deadbolts, and the direction that the doors swing is challenging to secure.

Painting is needed throughout the school and exterior doors are aged.

There is very little space for support professionals. Many specialists are making offices in closets to help accommodate.

There is considerable erosion throughout the campus., and the athletic fields have drainage issues.

Visitor seating for games is very small, the bleachers are portable.

The Gym is too small for competitive events (student-athletes travel).

The weight room for student athletes is very small and dated.

Storage space for custodians is very limited. Some of their equipment is stored in a doorway.

Class Sizes are too large for many classrooms.

If the One Cent Sales Tax is renewed by voters in November, an early look at the changes at Silver Bluff High School is below.

Area Three Elementary School

The Graniteville/Midland Valley Area has experienced substantial growth in housing and student numbers. To help alleviate overcrowding of the elementary schools in Area Three, a new elementary school will be constructed, if approved by voters. The school would be built at the optimum size for elementary schools (approximately 750 students).

Schematic design drawings are being prepared. The design drawings will be shared as soon as available.

If the One Cent Sales Tax is renewed by voters in November, an early look at the new Area Three Elementary School is below.

"Contingency Projects"

If the above projects have been completed or if all funding necessary for completion of the Projects has been provided, and if additional Tax revenue is available, any one or more of the following projects may be undertaken:

Repair or replacement of roofing at various facilities in the School District;

Construction of security vestibule and door lock upgrades at various facilities in the School District;

Classroom additions at Byrd Elementary School;

Replacement of Greendale Elementary School; and

Classroom additions at Gloverville Elementary School.

"We're sharing information with the community about the Sales Tax, as well as our school facilities that would be renovated, upgraded, and constructed, if renewed. Our hope is that citizens are familiar with what they'll see on The Ballot and can make an informed decision before Voting Day in November."

Dr. Corey Murphy

Superintendent

The Ballot Question

EDUCATION CAPITAL IMPROVEMENTS SALES AND USE TAX ACT REFERENDUM FOR AIKEN COUNTY

Shall The Consolidated School District of Aiken County, South Carolina (the “School District”), reimpose a special one percent education capital improvement sales and use tax (the “Tax”) in Aiken County (the “County”) for ten years with the revenue of the Tax to be used by the School District as follows:

1. 10% of the revenue from the Tax must be used to reduce property taxes by providing a credit against existing debt service millage within Aiken County on general obligation bonds of the School District;

2. 90% of the available revenue from the Tax after deducting 10% of the revenue identified in (1) above, must be used to provide a credit against millage imposed in the County for debt service as follows:

(a) by the School District (in the event a companion question on a dependent bond referendum should be unsuccessful) for retiring or defeasing existing or future eight percent bonded indebtedness during the imposition of the Tax; or

(b) by the School District for debt service on one or more general obligation bond issue(s) not to exceed in the aggregate $285,000,000, which shall be issued by the School District to facilitate construction and funding flexibility in an effort to lower construction costs, the proceeds of such bonds to be used to pay some or all of the costs of renovations and additions at South Aiken High School, Midland Valley High School, Silver Bluff High School and North Augusta Middle School; and construction of a new elementary school in Area 3 including, if necessary, the cost of purchasing land (the “Projects); provided that the total debt service on such general obligation bonds shall not exceed 90% of the available revenue received from the Tax; and

(c) If all of the Projects have been completed or if all funding necessary for completion of the Projects has been provided, and if additional Tax revenue is available, any one or more of the following projects may be undertaken: repair or replacement of roofing at various facilities in the School District; construction of security vestibule and door lock upgrades at various facilities in the School District; classroom additions at Byrd Elementary School; replacement of Greendale Elementary School; and classroom additions at Gloverville Elementary School?

3. The balance of the revenue from the Tax must be used to provide additional property tax reductions or to pay directly or indirectly a portion of the capital costs of the projects identified above.

All revenue received by the School District from the Tax will be used to reduce property taxes needed to pay debt service on School District bonds or to directly pay costs of education capital improvements projects of the School District identified herein.

If the voter wishes to vote in favor of the question, fill in the oval next to “In favor of the question/yes;” if the voter wishes to vote against the question, fill in the oval next to the words, “Opposed to the question/no.”

The Companion Question

GENERAL OBLIGATION BONDS

If and only if an Education Capital Improvements Sales and Use Tax (the "Tax:) is reimposed in Aiken County, shall the Board of Education of the Consolidated School District of Aiken County, South Carolina (the "School District"), be authorized to issue, in addition to the eight percent bonding capacity, at one time or from time to time, general obligation bonds of the School District in a principal amount not exceeding $285,000,000, the proceeds of which shall be used to finance the costs of renovations and additions at South Aiken High School, Midland Valley High School, Silver Bluff High School and North Augusta Middle School; and construction of a new elementary school in Area 3 including, if necessary, the cost of purchasing land; provided that the total debt service on such general obligation bonds shall not exceed 90% of the available revenue received from the Tax.

If the voter wishes to vote in favor of the question, fill in the oval next to "In favor of the question/yes;" if the voter wishes to vote against the question, fill in the oval next to the words, "Opposed to the question/no."

Voting Information

Early Voting

From Monday, October 21 – Saturday, November 2. (Closed Sunday October 27.), voters may cast their ballot early at one of the following Voting Centers, which are open 8:30 a.m.- 6:00 p.m. during the early voting period.

Aiken County Board of Regulations And Elections Office: 1930 University Pkwy Ste 1200 Aiken, SC 29801

North Augusta Community Center: 495 Brookside Ave. North Augusta, SC 29841

Aiken County Roy Warner Park: 4287 Festival Trail Rd. Wagener, SC 29164

O’Dell Weeks Recreational Center: 1700 Whiskey Rd, Aiken, SC 29803

Election Day-Tuesday, May 5, 2024

Polls will be open on Election Day from 7 a.m.-7 p.m. Please visit scVotes.gov for polling locations, and all election day information.